Is assessment of risk a function of interest rate?

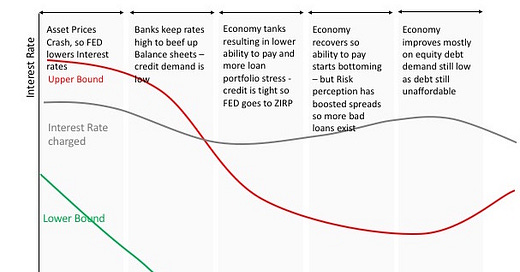

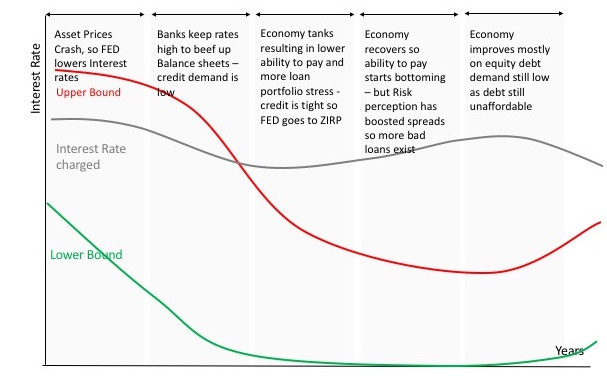

The interest rate that can be charged by the bank has two limits.

The Lower bound equals what the central bank charges the bank. Any lower and the bank will make a loss on its lending portfolio.

The Upper bound is the ability of the risk taker to bear the burden of return. Thus, if a bank lends to a business that makes 10% return on capital employed - it cannot charge more than 10% else it will be unviable for the borrower to seek the debt at all.

The Actual interest rate charged is determined by a combination of the following factors:

An assessment of returns of the business based on the economy and her business

Income of the borrower in total

The value of the collateral pledged against the loan as a security should the borrower be unable to bear that return

The demand for loans AND/OR

How well the other loans are doing (health of bank's loan portfolio) AND/OR

A combination of these along with global factors

Spread

Bankers think of returns as spread they make on top of the lower bound, i.e. rate set by the central bank.

Risk V/s Spread

Now, in the mind of the banker risk is correlated with the spread. When the banker perceives higher risk she fattens the spread. This "risk" we talk about is risk resulting to the banker. It does not mean risk of the borrower alone. So if the bankers' portfolio is turning bad, the banker will still increase the spread - partly to compensate for the loss she suffers and partly because she assesses the general economic environment to be more risky. Thus, even if the central bank reduces the benchmark interest rate, the banker is reluctant to pass it on if she can avoid it. This creates tighter conditions putting more stress on the borrower. This is why Scot Sumner argues the monetary conditions were actually tight when we were almost at ZIRP.

In an economy that is weak, it acts as a stronger head wind for borrowers. It reduces their ability to borrow and to service their current borrowing. They want to pay down their debt and reduce their loans. Therefore, the economy contracts further. The banks seem happy at first, but soon realise that other borrowers who are not prudent are pushed to default. The implication of this on the bank depends on the mechanics of the process - the proportion of those who default v/s those who pay back, the chronology in which it happens etc.

In the next phase, the economy recovers, predominantly with equity capital. Equity can absorb the losses since it is built for higher risk. The surviving firms and individuals are left with core strength to thrive in intense competition and are more prudent with capital allocation. The banks thereafter can lend to these survivors to help them scale up.

What does this mean?

This means,

There is inherent value to competitiveness that signifies its ability to survive and repay the debt and repay the equity at decent returns. This ability reduces with increasing leverage by the borrowers. Thus when Anat Admati suggests investment banks have capped leverage ratios to 20 or 10 it makes sense.

Banks' business model seems to encourage the use of debt only to amplify equity returns. It is fine in a way but if that is the objective then banks should reduce/cut lending at lot earlier than they do. Naturally, in times of distress when the return ON capital matters lesser than the return OF capital, banks get into big trouble. It seems they get confused about what is their business model.

Maybe, better than ZIRP, unleashing a new Government-backed Good Bank to pick up assets at distressed prices at lending rates with narrow and fixed spreads can work better. If the size of this bank is large enough in relation to the banking system, it may result in a lesser shock to the economy.

Buy my books "Subverting Capitalism & Democracy" and "Understanding Firms".